The Oil Rally Makes Dessert Expensive When Cane Turns Into Fuel

http://www.bloomberg.com/news/articles/2016-06-05/the-oil-rally-could-make-you-think-twice-about-ordering-dessertJune 07, 2016 at 12:38 PM

This year’s rebound in oil prices has an unlikely victim: the dessert plate.

To understand why, look no further than Usina Batatais SA, a sugar-cane processor in Sao Paulo. Enticing fuel margins mean the company is using a bigger cane crop to produce more ethanol, while keeping its raw sugar output unchanged. Even after sugar prices surged recently, “there’s no time and cane anymore” to make a switch, said Bernardo Biagi, Batatais’ president.

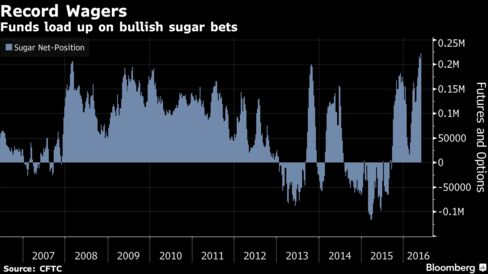

It’s a story that’s being played out across Brazil, the world’s biggest sugar producer and exporter. That could exacerbate the global supply deficit after droughts already hurt crops in India and Thailand, the No. 2 shipper. Prices are trading near the highest in almost two years, and hedge funds are making a record bet that the rally will continue.

“The ethanol margins have been good, and it’s been directing more of the sugar cane in the direction of the ethanol industry,” said Arlan Suderman, the chief commodities economist at INTL FCStone Financial Inc. in Kansas City, Missouri. “If you look at global sugar production, the Center-South area of Brazil is really the only bright spot in world production right now. Therefore, the world’s looking to them.”

Price Rally

Raw sugar has jumped 24 percent this year on ICE Futures U.S. in New York. Prices on Monday touched 19.42 cents a pound, the highest for a most-active futures contract since October 2013. Hedge funds and other large speculators boosted their net-long holdings in the commodity by 4.9 percent to 222,686 U.S. futures and options in the week ended May 31, Commodity Futures Trading Commission data showed three days later. That’s the highest since the data begins in 2006.

Analysts and traders are also expecting more price gains. Futures could reach 19.9 cents by the end of the year, according to the average of 15 estimates in a Bloomberg News survey. More than half of the participants predicted that the sweetener will touch 20 cents, which would be the highest since October 2013.

“Weather issues and the shortage will keep the market in an uptrend,” said Donald Selkin, the chief market strategist at National Securities Corp. in New York who helps manage about $3 billion. He predicts July futures will reach 20 cents within a few weeks.

Prices have already advanced for four straight months amid drought conditions in Thailand and India, the second-biggest grower. For farmers such as 51-year-old Prabhu Chougule, who grows sugar cane and peanuts on 45 acres in India’s state of Maharashtra, the dry weather can have devastating consequences for his crops. Without rains coming soon, he estimates that his output will drop 25 percent from last season.

‘Really Bad’

“The situation is really bad,” Chougule said. “Everyone is anxiously looking at the sky waiting for the rain.”

While output was declining from Asia, analysts had thought that a big crop from Brazil could help buoy supplies. That outlook has changed amid worsening expectations for Indian and Thai output. Exports from South America won’t be enough to balance the global market, according to Citigroup Inc. On May 18, Brisbane, Australia-based Green Pool Commodity Specialist Ltd. raised its projection for this season’s global deficit by 28 percent. The firm also increased its outlook for next year’s shortfall.

Adding to the supply squeeze, heavy rains are now disrupting harvesting and shipping in Brazil. The port of Santos had its wettest May since at least 2013. The showers also hampered cane crushing in the Center-South region during the second half of May, said Antonio de Padua Rodrigues, technical director at industry group Unica.

Still, the shipping backlog in Brazil could prove to be temporary. At the same time, the recent gains for sugar prices could prompt millers to rethink their move to produce more ethanol, and instead turn to the sweetener. In the second half of May, processors used 56 percent of the cane crop to make ethanol, down from 62 percent a year earlier, data from industry group Unica showed June 1. Also helping to ease the deficit, demand growth for the sweetener has been tepid amid slowing global economies and consumer health concerns.

The outlook “is really two-pronged,” said Lara Magnusen, a La Jolla, California-based portfolio manager at Altegris Advisors, which manages $2.44 billion. “You’ve had this crazy weather driven by El Nino, which has really hit India in particular. Brazil has actually produced quite a bit. But overall we still have a sugar deficit, and that’s assuming average demand. If we start to see China ratchet up their imports, then you could really see sugar prices take off. By the same token, if demand stumbles into China -- that could spell trouble for sugar.”